All Dependents If YES go to Step 2. You cannot claim the additional child tax credit.

2020 Schedule 8812 Form And Instructions Form 1040

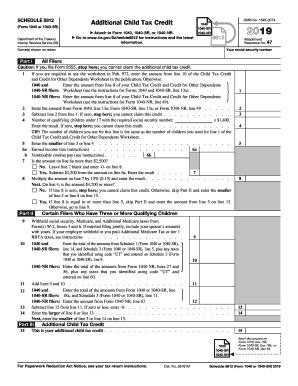

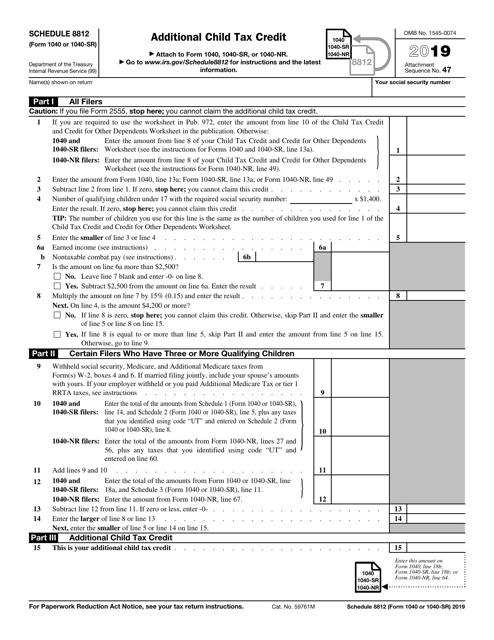

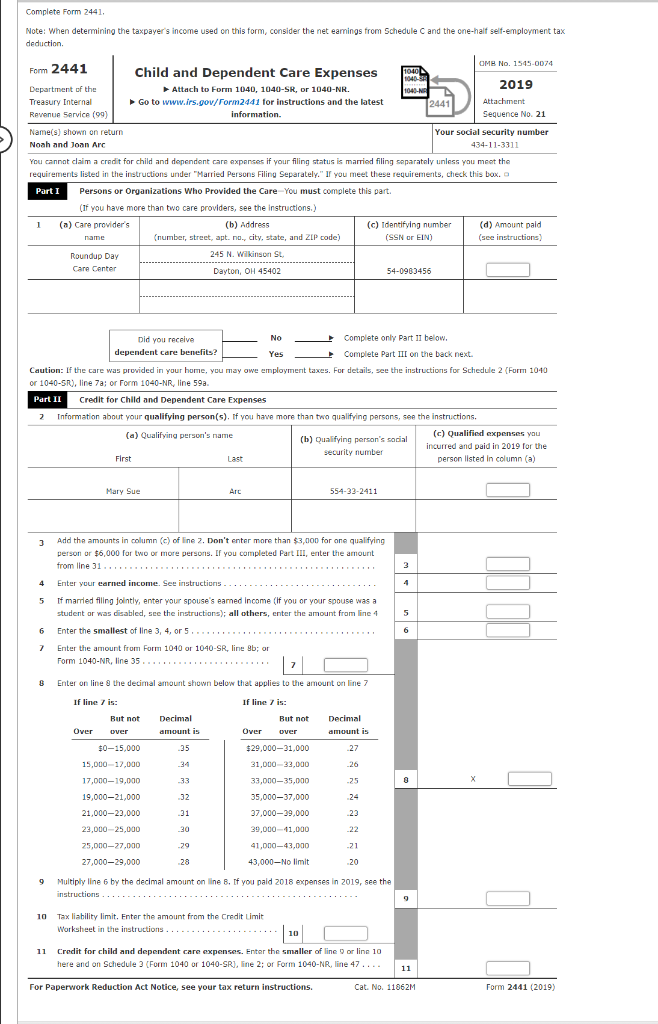

Child Tax Credit Credit for Other Dependents 24-1 Child Tax Credit Credit for Other Dependents Introduction The child tax credit is unique because if a taxpayer cannot benefit from the nonrefundable credit the taxpayer may be able to qualify for the refundable additional child tax credit on Schedule 8812 Additional Child Tax Credit.

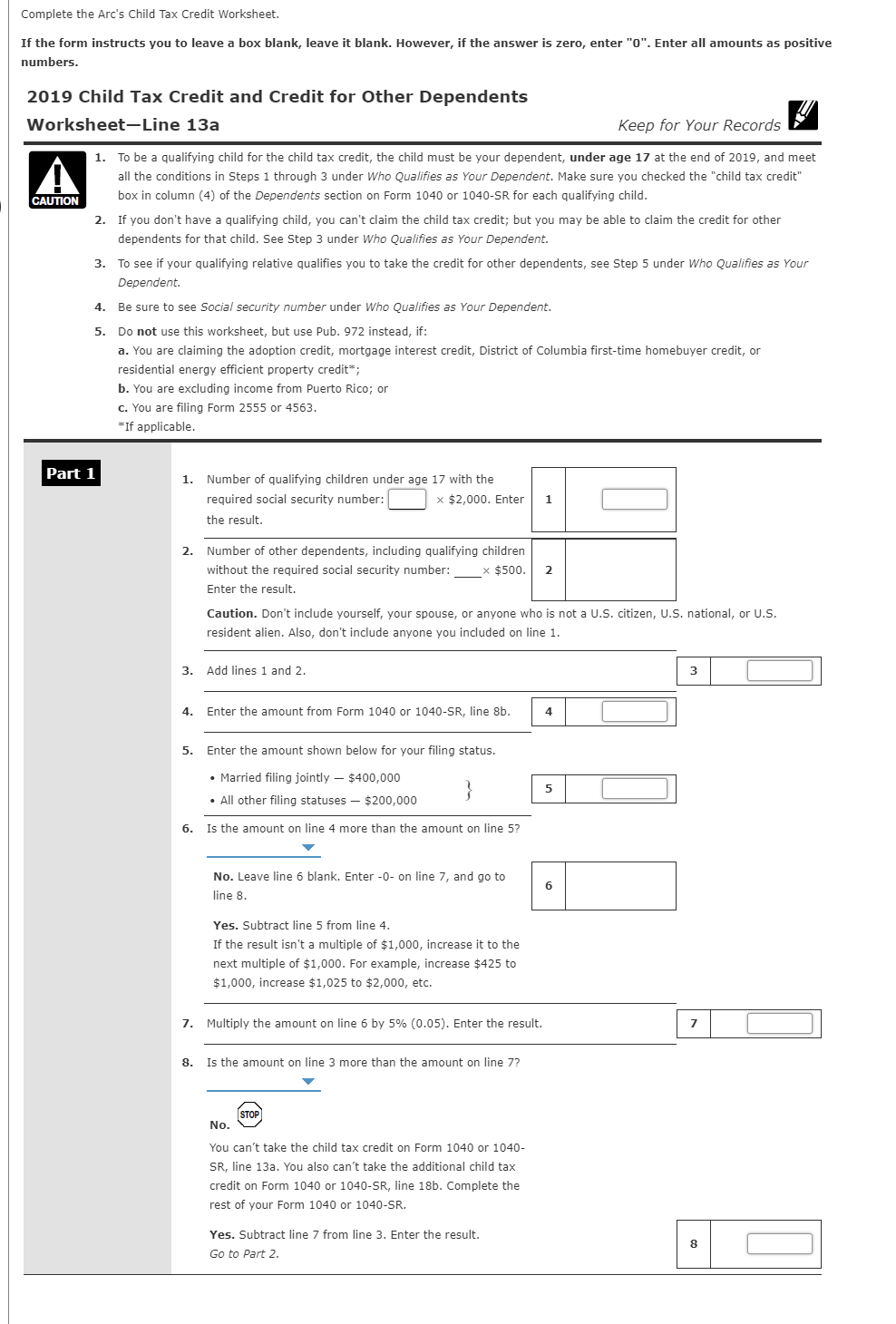

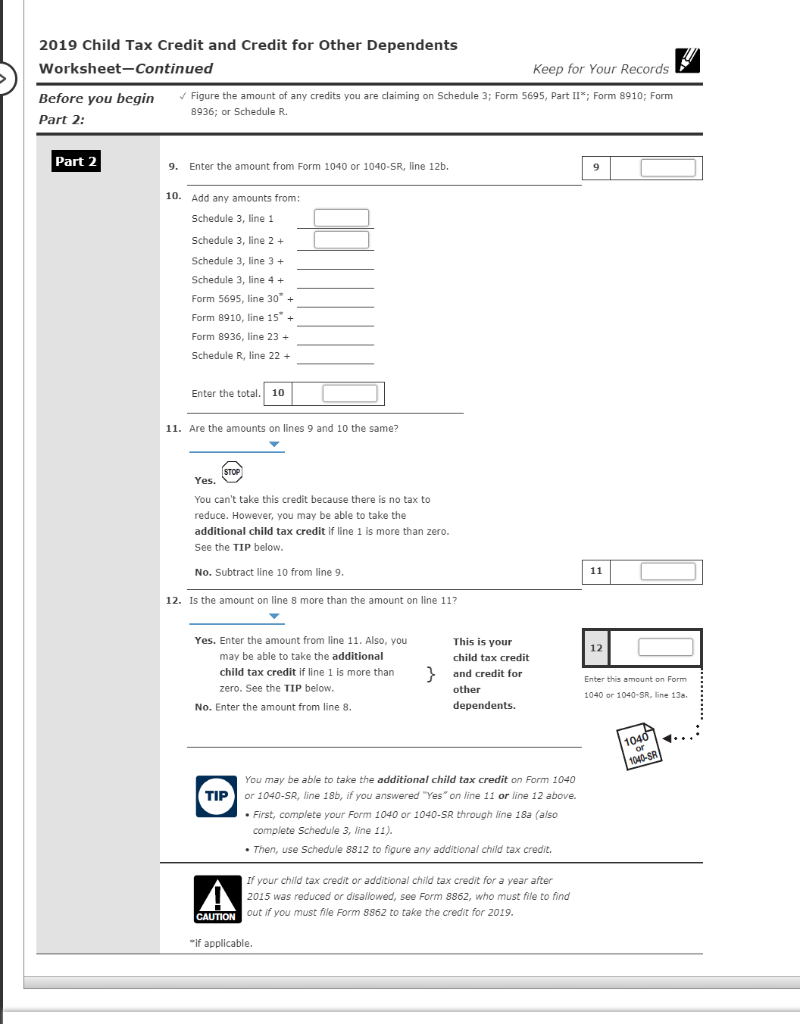

Child tax credit and credit for other dependents worksheet 2019. Start with the Child Tax Credit and Credit for Other Dependents Worksheet later in this publi-cation. The American Rescue Plan temporarily expands the child tax credit from 2000 per child 16 years old and younger to 3600 for children age 5 and younger and to 3000 for children. The maximum credit for other dependents is 500 and it has the same phase-out threshold as the CTC.

It is in addition to the credit for child and dependent care expenses on Schedule 3 Form 1040 line 2 and the earned income credit on Form 1040 or. 1040 and 1040-SR filers. 972 enter the amount from line 10 of the Child Tax Credit and Credit for Other Dependents Worksheet in the publication.

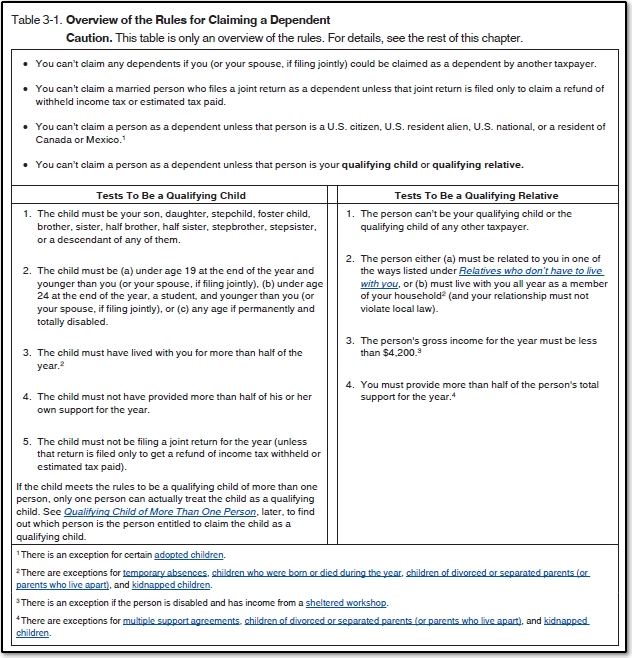

The 2020 Schedule 8812 Instructions are published as a separate booklet which you can find below. See the instructions for Form 1040 line 19 or Form 1040NR line 19. See Tab C Dependents Table 1.

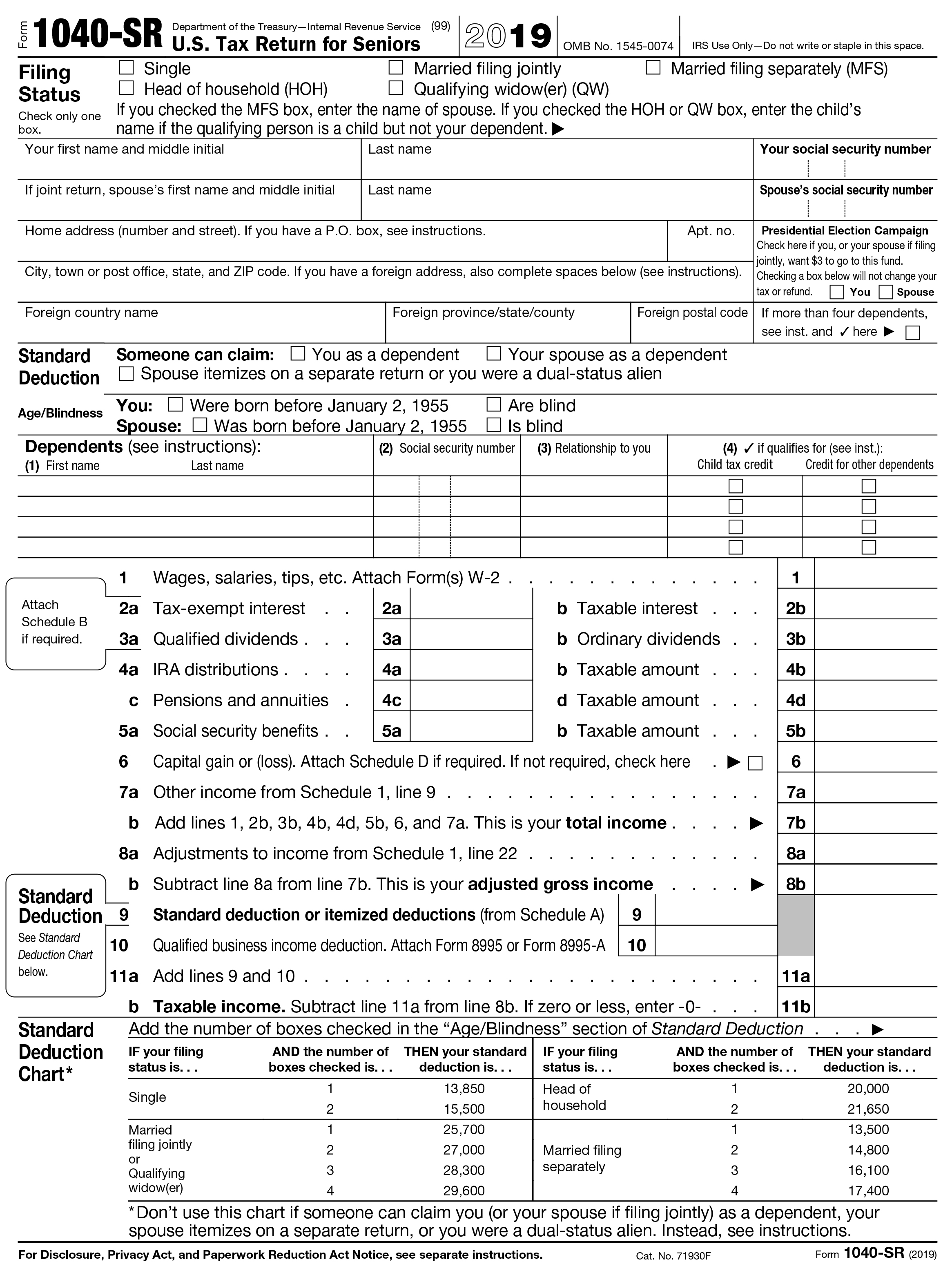

Complete the Earned Income Work-sheet later in this publication. 13a Child tax credit or credit for other dependents. IRS Tax Tip 2019-138 October 3 2019 Taxpayers with dependents may qualify to claim a few different tax credits.

You only need to complete the other worksheets in this publication if you also were. Otherwise 1040 and Enter the amount from line 8 of your Child Tax Credit and Credit for Other Dependents 1040-SR filers Worksheet see the instructions for Forms 1040 and 1040-SR line 13a. If NO you cant claim the child tax credit for this person.

972 enter the amount from line 10 of the Child Tax Credit and Credit for Other Dependents Worksheet in the publication. 2019 Child Tax Credit and Credit for Other Dependents Worksheet Line 13a Keep for Your Records 1. Enter the amount from line 8 of your Child Tax Credit and Credit for Other Dependents.

Enter this amount on Form 1040 line 12a. You only need to complete the other worksheets in this publication if you also were. Then use Schedule 8812 to gure any additional child tax credit.

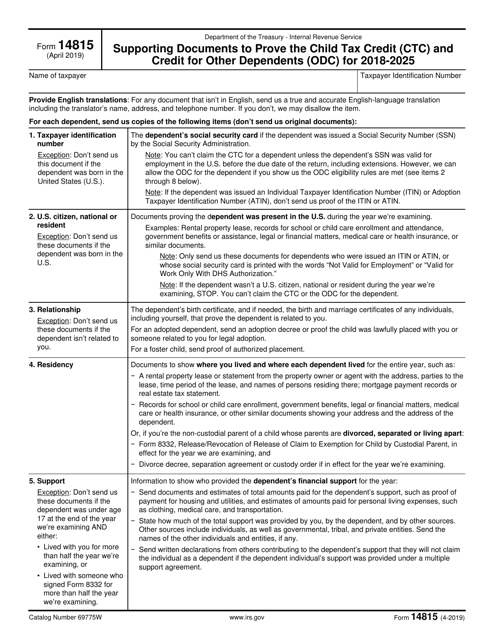

Earned Income Credit EIC American Opportunity Tax Credit AOTC Child Tax Credit CTC including the Additional Child Tax Credit ACTC and Credit for Other Dependents ODC and Head of Household HOH Filing Status Attachment To be completed by preparer and filed with Form 1040 1040-SR 1040-NR 1040-PR or 1040-SS. To be a qualifying child for the child tax credit the child must be your dependent under age 17 at the end of 2019 and meet all the conditions in Steps 1 through 3 under Who Qualifies as Your Dependent. Step 1 Is this person your qualifying child dependent.

4 5 Enter the number of children from line 4 that were at least four but less than 17 years of age on December 31 2019. This is your total tax name. Form 1040 Schedule 8812 Additional Child Tax Credit asks that you first complete the Child Tax Credit and Credit for Other Dependents Worksheet.

5 If you entered 0 on line 5 stop. _ b Add Schedule 3 line 7 and line 13a and enter the total 14 Subtract line 13b from line 12b. To claim the child tax credit andor the credit for other dependents you cant be a dependent of another taxpayer.

If the dependent doesnt meet those qualifications the taxpayer may be able to claim the credit for other dependents. Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later. If you are required to use the worksheet in Pub.

One of these is the child tax credit. This is your child tax credit and credit for other dependents. Other older dependents such as an elderly parent.

Go to wwwirsgovForm8867 for instructions and the latest information. To help you determine exactly how much of the credit you qualify for you can use the Child Tax Credit and Credit for Other Dependents Worksheet provided by the Internal Revenue Service. Line 1 Both IRS Publication 972 and the Instructions for Form 1040 include a Child Tax Credit and Credit for Other Dependents Worksheet to help determine whether you qualify to claim the CTC or the ACTC and calculate the amount of the credit.

If zero or less enter 15 Other taxes including self-employment tax from Schedule 2 16 Add lines 14 and 15. 4 Enter the number of children who qualify for the federal child tax credit additional child tax credit or credit for other dependents see instructions. The child tax credit benefits people whose dependent meets a series of tests.

Enter all amounts as positive numbers. Start with the Child Tax Credit and Credit for Other Dependents Worksheet later in this publi-cation. If you were sent here from your Instructions for Schedule 8812.

If you were sent here from your Instructions for Schedule 8812. Child Tax CreditOther Dependent CreditEarned Income Credit Due DiligenceHead of Household 2019 Tax Credit Due Diligence CTC ODC EITC Page 2 Dependents are either Qualifying Children QC or Qualifying Relatives QR The requirements for all dependents are. Enter the amount from Line 10 of the Child Tax Credit and Credit for Other Dependents Worksheet in Publication 972 or Line 8 of the worksheet in.

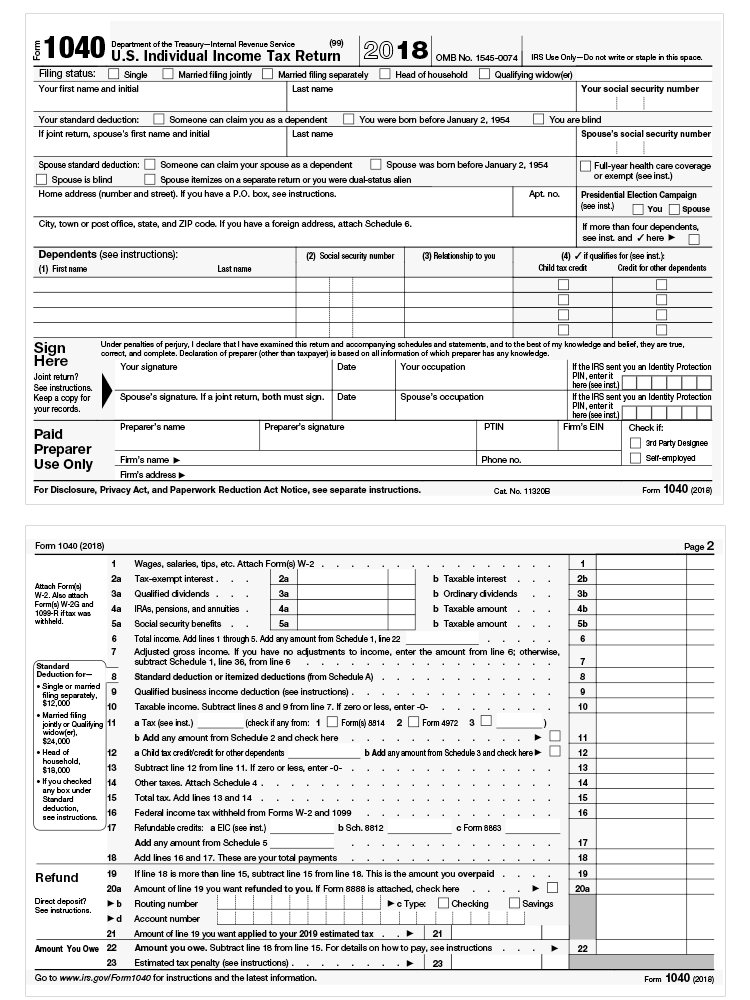

You do not qualify for this credit. If you need to file a return for a year before 2018 you can only claim the credit on Forms 1040 1040A or. First complete your Form 1040 through line 17a also complete Schedule 5 line 72.

If you are required to use the worksheet in Pub. Complete the Earned Income Work-sheet later in this publication. You may be able to take the additional child tax credit on Form 1040 line 17b if you answered Yes on line 11 or line 12 above.

A child who is age 18 or age 19 to 24 and in school. You cannot claim both the child tax credit and the credit for other dependents.

Child Tax Credit 2019 Fill Out And Sign Printable Pdf Template Signnow

Form 1040 Gets An Overhaul Under Tax Reform Putnam Wealth Management

Child Tax Credit Worksheet 2019 Fill Online Printable Fillable Blank Pdffiller

Pin On Houston Real Estate By Jairo Rodriguez

Instructions Comprehensive Problem 1 Part 3 Form Chegg Com

Irs Form 14815 Download Fillable Pdf Or Fill Online Supporting Documents To Prove The Child Tax Credit Ctc And Credit For Other Dependents Odc Templateroller

More Individuals May Be Eligible To Claim Expanded Child Tax Credit For 2018

Form 1040 U S Individual Tax Return In 2021 Irs Tax Forms Tax Forms Irs Taxes

Instructions Comprehensive Problem 1 Part 3 Form Chegg Com

Irs Releases New Not Quite Postcard Sized Form 1040 For 2018 Plus New Schedules Tax Forms Income Tax Irs Tax Forms

W 4 Changes Allowances Vs Credits Datatech

Schedule 8812 What Is Irs Form Schedule 8812 Filing Instructions

Form 2555 Ez Foreign Earned Income Exclusion Internal Revenue

Instructions Comprehensive Problem 1 Part 3 Form Chegg Com

Irs Form 1040 1040 Sr Schedule 8812 Download Fillable Pdf Or Fill Online Additional Child Tax Credit 2019 Templateroller

11529 Qualifying Child Or Relative As A Dependent

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Tax Forms

No comments:

Post a Comment